A university education is often considered to be the best path to superior lifetime earnings and financial freedom. Actual earnings seem to bear this out. People with a four-year degree make far more over their lifetimes than those without—about 75% according to this study by the Federal Reserve Bank of San Francisco. But this path must be weighed against alternatives. Bitcoin is also an excellent investment, with a 71% average compound annual growth rate (CAGR) over the past ten years. The growth trajectory of bitcoin has created an alternative path to financial freedom. What if we invested in bitcoin instead of time and tuition for university? Which would yield more over a career?

Valuing university education

The price of a university education has vastly outpaced inflation, with tuition going up more than 250% in inflation-adjusted dollars in the past 40 years and 830% in nominal terms. Furthermore, many observers claim that universities have shifted focus over time toward politicization and controlling speech more than free inquiry and entertainment of students more than quality education, leading many parents to question the investment. Parents and students are rightly asking now whether university is worth the investment. Confidence in higher education has dropped precipitously from 57% in 2015 to 36% in 2023. Students are beginning to vote with their feet; college enrollment has dropped in the US for recent high school graduates from a high of 70% in 2009 to 61% in 2023. Parents and students are looking for other options.

Even the 75% college wage premium is misleading. The reality is that the group of students who achieve a four-year degree tend to be smarter and harder working than those who go to work right out of high school. This number doesn’t tell us what the premium would be for an individual student who could achieve a four-year degree but chooses not to.

In his book The Case Against Education, Bryan Caplan makes the case that the college wage premium drops considerably when considering an individual student rather than the group. His extensive data analysis shows that the college wage premium drops in half when isolating an individual student of comparable ability in high school and college. That is, the college wage premium is closer to 38% for an individual. The same individual who would earn $1M over a lifetime of wages without a degree would be expected to earn $1.38M with a degree.

Even this adjustment overestimates the added value of college, where Caplan calculates that approximately 80% of the added value is merely signaling—demonstrating to employers that the student is the kind of student who has the characteristics to achieve a four-year degree and be successful in the workplace. Only 20% is actually added value from education.

In addition to the cost of university and the relatively small gains, students sacrifice four years of lost wages while they are in school. This four years could be invested not only in making money but in gaining valuable skills that would make them more competitive and useful in the marketplace after four years.

Valuing bitcoin investment

Bitcoin represents an entirely new asset class—a digital asset whose supply remains absolutely scarce regardless of demand. As governments demonstrate a complete inability to say no to borrowing and printing new fiat money, both sophisticated investors and ordinary people are looking for an asset that can’t be inflated by any powerful individual, government, or bank. As the world continues the process of becoming familiar with bitcoin and adding it to their holdings, absolute scarcity means the price of bitcoin can only trend up in the long term. This is borne out in bitcoin’s superior returns over its lifetime that has exceeded every other common asset class in 11 out of 14 years. Bitcoin’s 71% CAGR over the past 10 years has dwarfed the 11% that the S&P 500 has yielded in the same period.

Bitcoin has superior scarcity, portability, and verifiability compared to gold. It has a very low cost of ownership and little jurisdictional risk. It has some immunity to regulatory risk compared to other assets. The properties of bitcoin strongly suggest that it will significantly eat into the existing store of value of gold, bonds, real estate, and stocks.

Michael Saylor has recently published a 21-year price forecast for bitcoin. His bear case estimates a 21% CAGR, a base case 29%, and a bullish case 37%. If bitcoin has returns like this, students and parents need to consider this alternative closely before investing tuition money up front and forgoing four years of income and practical skill development.

Another price model, the power-law model promoted by @Giovann35084111 and others, has demonstrated remarkable fidelity to price over the history of bitcoin. This model predicts more rapid growth early on with gradually decreasing returns as bitcoin matures. It posits that the price of bitcoin on average increases in proportion to time raised to the sixth power, where time refers to total time since the genesis block. This model projects about a 45% CAGR in the coming year, falling gradually to around 25% in ten years.

Comparing the two

We look at both options as investment in capital—a university education as an investment in human capital and bitcoin as an investment in an appreciating capital asset.

The cost of a university education involves both direct costs and opportunity costs: 1) paying four years of university tuition and 2) forgoing four years of income and valuable job experience. The payoff is an expected wage premium of 38% over a career. The alternative we consider here is to invest in bitcoin beginning on Day 1 the funds that were saved for tuition. In addition, we assume that parents pay living expenses for four years in either scenario. Thus, living expenses are not added to the cost of the university option and are not subtracted from the non-university wages. Instead, all of net salary is used to buy bitcoin at the end of each year for the four years that the parents would have otherwise supported a student at university.

We assume in both scenarios that the salary grows by 3% per year. This is intended to account for inflation as well as real growth. Dollar values and models are assumed to be in nominal values and are not adjusted for inflation. Since we are comparing two scenarios across the same time frame, the exact level of inflation has very little impact on the relative performance of the two.

Tuition varies dramatically across university categories. For the year 2024-2025, in-state tuition at a ranked public university in the U.S. averages $11K per year. Out-of-state tuition runs $25K per year. Students attending a private college will pay an eye-watering $44K per year. And Ivy League tuition will set families back $65K per year. Community colleges cost less than four-year universities. In addition, some students will qualify for scholarships and other financial aid. And some may live in places where tuition is free (well—paid for by further fiat money printing).

Let’s consider two cases—an in-state public university and free tuition. We assume in the bitcoin alternative that the amount of yearly tuition is used to purchase bitcoin annually as a kind of dollar-cost averaging to spread the risk of the time of entry in the market.

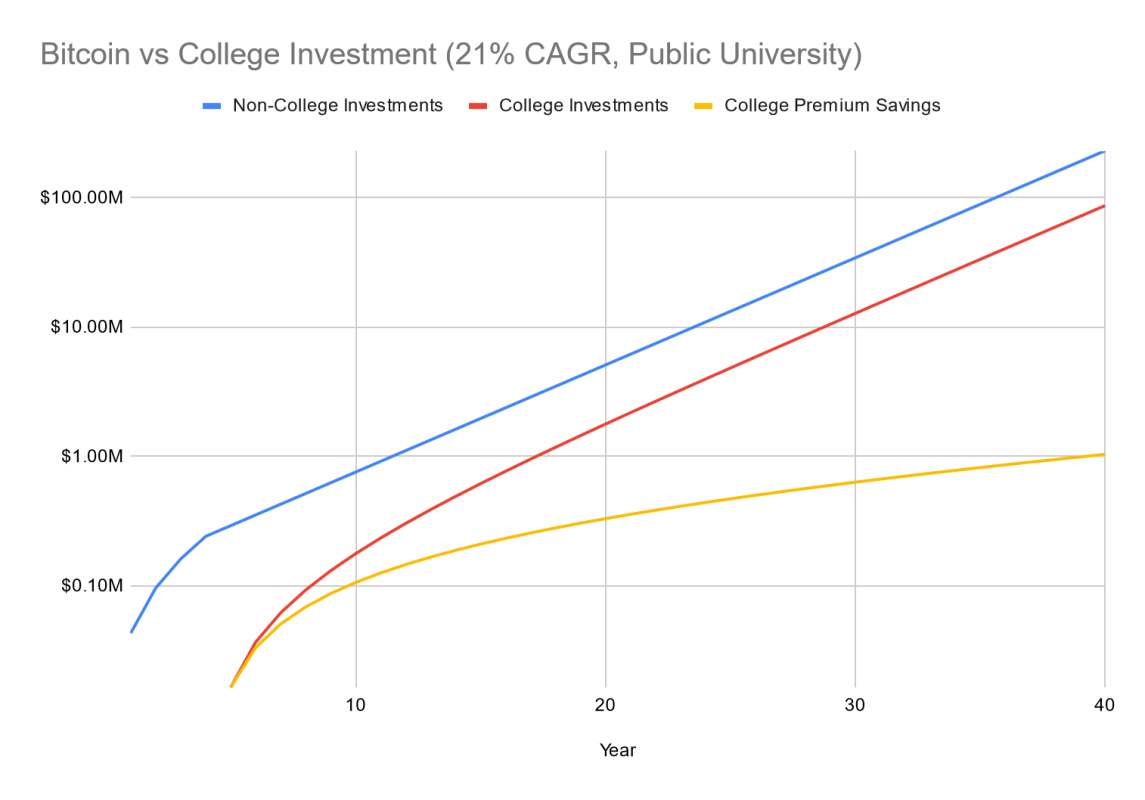

For the bitcoin price model, we consider two scenarios: the Saylor bear case (21% CAGR) and the power-law model that starts with a higher return and gradually falls over time, in keeping with its historic power-law curve.

We compare results over a 40-year career (4 university years + 36 working years for the university case). We assume that the base non-college take-home pay is $30K per year, and the annual college premium is calculated so that the total lifetime premium is 38%. We assume the non-college path saves the bitcoin purchased with tuition money and the first four years of take-home pay and nothing after that. The college path purchases bitcoin with the college wage premium each year and lives off of the same take-home pay as the non-college path.

In each plot we show three values over time:

- Non-College Investments: Dollar value of bitcoin from purchases made from saved tuition and wages earned in first four years

- College Investments: Dollar value of bitcoin from purchases made from college wage premium each year

- College Premium Savings: Dollar value of cumulative savings from college wage premium (not invested in bitcoin)

To give the college option the most favorable possible treatment, we assume that the college wage premium is also invested in bitcoin each year.

Results

Even in the Saylor bear case (21% CAGR), investing tuition money and the first four years of income in bitcoin far outperforms the college wage premium over a career. The college wage premium never catches up even after 40 years. Because of the bitcoin investment in both scenarios, both are very attractive. If we define financial freedom as having $5M in bitcoin savings, that is achieved in 20 years for the non-college path and in 25 years for the college route. By comparison, merely saving the college premium in fiat without investing in bitcoin is an abysmal strategy, returning less than 1/200 of the non-college path and about 1/100 of the college path with bitcoin investment.

Now let’s suppose your student gets free tuition, either through a scholarship or government-subsidized tuition. In that case the only advantage the non-college route has is to save four years of income before being on the same footing as the college route.

The results show that even in this case the non-college route yields a better return simply by being able to invest four years of salary instead of deferring superior wage by four years.

What if the bitcoin power law continues to match the appreciation of bitcoin? We consider both public university tuition and free tuition.

In this case the non-college path dramatically outperforms the college path, whether or not tuition is free. The public university tuition alternative with the power law achieves financial freedom ($5M) in only 15 years from high school—at age 33.

Other scenarios

What happens if these scenarios are overly optimistic for the performance of bitcoin? If we drop the bitcoin CAGR all the way down to 10% for the public university case, the two scenarios basically break even. If we go all the way down to a 5% CAGR, it still takes 18 years for the college path to pay off relative to the non-college path.

What if the college path prepares the student for a more lucrative career—like engineering, medicine, or law—where the college path may be the only option for those careers and where the college wage premium may be much higher? In the case of a public university with a 21% bitcoin CAGR, the premium must be 113% to reach the breakeven point over a 40-year career.

That’s not the whole story. Medicine and law require even more years of deferred wages and even more tuition than a four-year degree. Assuming eight years of deferred wages and eight years of public university tuition (surely an underestimate for medical or law school tuition), the college wage premium must be a towering 300% just to break even. Engineering appears to be the sweet spot here—preparation for a professional career in four years with a larger-than-average expected wage premium. Even here, however, the required breakeven premium of 113% is a tall order.

If you’d like to investigate other scenarios, here is a Google Sheet where you can experiment with the parameters and even look at the formulas I used to create these calculations.

Broader considerations

This analysis narrowly focuses on the financial payoff of a capital investment. It doesn’t consider personal satisfaction derived from the alternative paths, motivation, the networking benefits of a university, the personal growth experience of a university vs. working directly from high school, and many other factors. It also doesn’t consider the potential volatility of bitcoin, either concerning the uncertainty or the additional stress of riding the bitcoin rollercoaster.

If the thesis concerning bitcoin appreciation is anywhere close to accurate, these findings suggest that a non-university path with a bitcoin savings strategy is likely to be financially advantageous compared to a university education path even with a bitcoin savings strategy. This conclusion frees up students and parents to give more subjective consideration to other paths that may fit their personality, values, and goals. Bitcoin not only gives a path for financial freedom but a path toward greater freedom in career choices less constrained by financial or academic factors.

This is a guest post by Stan Reeves. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

from Bitcoin Magazine - Bitcoin News, Articles and Expert Insights https://ift.tt/QYXtAOH

0 Comments